UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under § 240.14a-12 |

Ekso Bionics Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: | |

EKSO BIONICS HOLDINGS, INC.

1414 Harbour Way South, Suite 1201

Richmond, California 94804

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 20, 2017

NOTICE IS HEREBY GIVEN that the 2017 Annual Meeting of Stockholders (the “Meeting”) of Ekso Bionics Holdings, Inc., a Nevada corporation (the “Company”), will be held at the offices of the Company at 1414 Harbour Way South, Suite 1201, Richmond, California 94804 on Tuesday, June 20, 2017 at 8:30 a.m., local time, for the purpose of considering and voting upon the following matters:

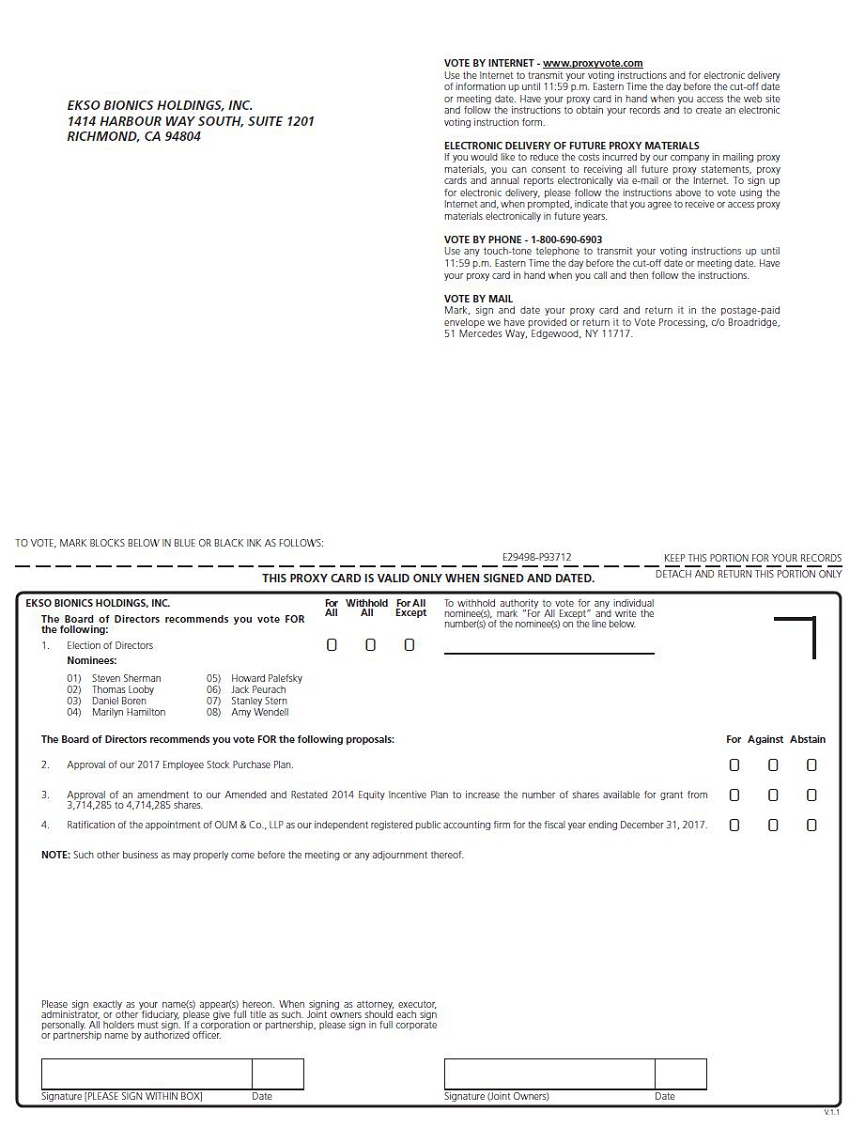

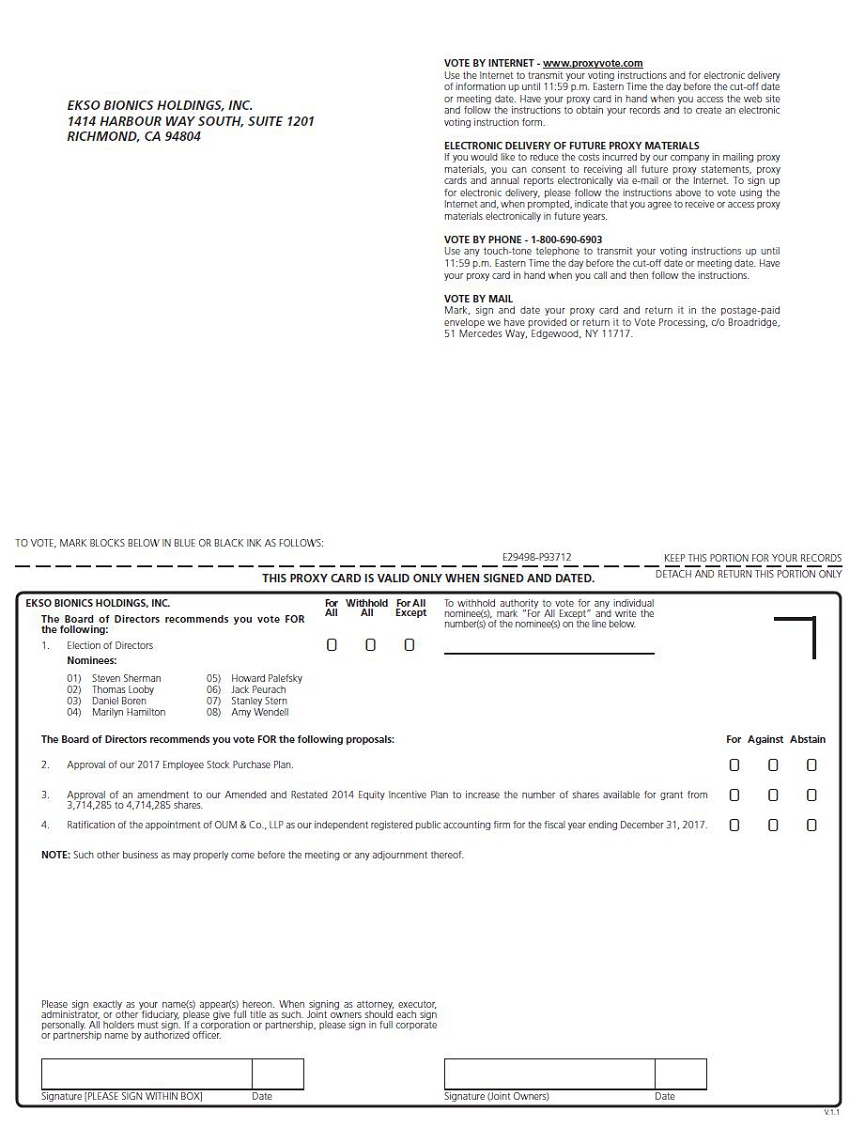

| 1. | To elect eight members of our Board of Directors to serve until the annual meeting of stockholders to be held in 2018 and until their respective successors are elected and qualified; |

| 2. | To approve our 2017 Employee Stock Purchase Plan; |

| 3. | To approve an amendment to our Amended and Restated 2014 Equity Incentive Plan to increase the number of shares available for grant from 3,714,285 shares to 4,714,285 shares; |

| 4. | To ratify the appointment of OUM & Co., LLP as the Company’s independent auditors for the year ending December 31, 2017; and |

| 5. | To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on April 25, 2017 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof.

If you would like to attend the Meeting and your shares are held by a broker, bank or other nominee, you must bring to the Meeting a recent brokerage statement or a letter from the nominee confirming your beneficial ownership of such shares. You must also bring a form of personal identification. In order to vote your shares at the Meeting, you must obtain from the nominee a proxy issued in your name.

We have elected to provide our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules, which allows us to conserve natural resources and reduce our printing and mailing costs related to the Meeting. On or about April 28, 2017, we will mail to our stockholders of record as of April 25, 2017 a notice containing instructions on how to access our proxy statement and annual report on the Internet and also how to vote their shares. If you received a notice by mail you will not receive a printed copy of the proxy materials unless you specifically request them. Both the notice and this Proxy Statement contain instructions on how you can request a paper copy of the proxy statement and annual report.

Your vote is important. Whether or not you plan to attend the Meeting we hope you will vote as soon as possible. If you received a Notice of Internet Availability of Proxy Materials, you can vote via the Internet at www.proxyvote.com. If you received printed proxy materials, you may vote via the internet, by telephone, or by mail.

| By Order of the Board of Directors, | |

| /s/ Thomas Looby | |

| Thomas Looby | |

| President and Chief Executive Officer |

Richmond, California

April 28, 2017

TABLE OF CONTENTS

i

EKSO BIONICS HOLDINGS, INC.

1414 Harbour Way South, Suite 1201

Richmond, California 94804

PROXY STATEMENT

2017 Annual Meeting of Stockholders

To Be Held On June 20, 2017

This Proxy Statement, a Proxy Card and an Annual Report to Stockholders for the year ended December 31, 2016 have been provided to you on the Internet, or upon your request, have been delivered to you, in connection with the solicitation of proxies by the Board of Directors of Ekso Bionics Holdings, Inc., a Nevada corporation (the “Company”), for use at the 2017 Annual Meeting of Stockholders to be held on Tuesday, June 20, 2017, at 8:30 a.m., local time, at the offices of the Company at 1414 Harbour Way South, Suite 1201, Richmond, California, and at any adjournment or postponement thereof (the “Meeting”). All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Stockholders. Unless the context otherwise requires, references to the “Company,” “we,” “us,” and “our” refer to Ekso Bionics Holdings, Inc.

We are mailing a Notice Regarding Internet Availability of Proxy Materials, or paper copies of the proxy materials, to our stockholders of record as of April 25, 2017 (the “Record Date”), for the first time on or about April 28, 2017.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving access to these proxy materials?

We are providing these proxy materials to you in connection with the solicitation by our Board of Directors of proxies to be voted at the Meeting to be held on Tuesday, June 20, 2017, at 8:30 a.m., local time, at the offices of the Company at 1414 Harbour Way South, Suite 1201, Richmond, California. As a stockholder of record or beneficial owner of shares of the Company at the close of business on the Record Date, you are invited to attend our Meeting and are entitled and requested to vote on the proposals described in this Proxy Statement. You are strongly encouraged to read this Proxy Statement and the Annual Report, which include information that you may find useful in determining how to vote.

What is the purpose of the Meeting?

At the Meeting, our stockholders will consider and vote upon the following matters:

| 1. | To elect eight members of our Board of Directors to serve until the annual meeting of stockholders to be held in 2018 and until their respective successors are elected and qualified; |

| 2. | To approve our 2017 Employee Stock Purchase Plan; |

| 3. | To approve an amendment to our Amended and Restated 2014 Equity Incentive Plan to increase the number of shares available for grant from 3,714,285 shares to 4,714,285 shares; |

| 4. | To ratify the appointment of OUM & Co., LLP as the Company’s independent auditors for the year ending December 31, 2017; and |

| 5. | To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

| 1 |

Members of our Board of Directors and management and representatives of OUM & Co., LLP, our independent registered public accounting firm, will be present at the Meeting to respond to appropriate questions from stockholders.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a paper copy of the proxy materials?

We are pleased to be using the U.S. Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish proxy materials to their stockholders primarily over the Internet instead of mailing printed copies of those materials to each stockholder. This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Meeting, and help conserve natural resources. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials, which will be mailed to our stockholders commencing on or about April 28, 2017, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet. Electronic Copies of our proxy materials are available at www.proxyvote.com.

If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice of Internet Availability of Proxy Materials and this Proxy Statement.

Who is entitled to vote at the Meeting?

Only common stockholders as of the close of business on the Record Date are entitled to notice of and to vote at the Meeting. As of the Record Date, there were issued and outstanding and entitled to vote 25,634,568 shares of common stock, $0.001 par value per share.

What are the voting rights of the holders of common stock?

Each outstanding share of our common stock will be entitled to one vote on each of the proposals presented at the Meeting.

Who can attend the Meeting?

All of our stockholders as of the Record Date may attend the Meeting.

Even if your shares are held in “street name,” as the beneficial owner of shares, you are invited to attend the Meeting. However, if you wish to attend the Meeting, please bring to the Meeting your bank or brokerage statement or a letter from your nominee evidencing your beneficial ownership of our stock and a form of personal identification. We reserve the right to deny admittance to anyone who cannot show valid identification or sufficient proof of share ownership as of the Record Date.

Please contact us at (510) 984-1761 or customerrelations@eksobionics.com for directions to the Meeting.

Can I find out who the stockholders are?

A list of stockholders will be available for examination by any stockholder, for any purpose germane to the Meeting, during ordinary business hours for ten days prior to the Meeting at the office of the Secretary of the Company at the above address, and at the time and place of the Meeting.

How many shares must be present to hold the Meeting?

A quorum must be present at the Meeting for any business to be conducted. Stockholders representing a majority of the votes entitled to be cast at the Meeting will constitute a quorum. Proxies received but marked as abstentions or treated as broker non-votes will be included in the calculation of the number of shares considered to be present at the Meeting.

| 2 |

What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in “street name”?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Meeting or vote by proxy as instructed below.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account by a bank, broker or other nominee (the record holder of your shares), then you are the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your record holder how to vote your shares of common stock, and the record holder is required to vote your shares of common stock in accordance with your instructions.

How do I vote?

If on the Record Date you are the stockholder of record and you received a Notice of Internet Availability of Proxy Materials, you may vote:

| · | Over the Internet. Go to the website of our tabulator, Broadridge Financial Solutions, Inc. (“Broadridge”), at www.proxyvote.com. Have your Notice of Internet Availability of Proxy Materials in hand when you access the website and follow the instructions to access the proxy materials and vote your shares. You must submit your Internet proxy before 11:59 p.m., Eastern Time, on Monday, June 19, 2017, the day before the Meeting, for your proxy to be valid and your vote to count. |

| · | In Person at the Meeting. You can vote in person by attending the Meeting and completing a ballot, which we will provide to you at the meeting. |

| · | Vote by Mail or Telephone: You may only vote by mail or telephone if you received your proxy materials by mail. If you wish to request printed copies of proxy materials by mail, you may do so at www.proxyvote.com, by calling 1-800-579-1639 or by sending an email to sendmaterial@proxyvote.com. |

If on the Record Date you are the stockholder of record and you received your proxy materials by mail, you may vote:

| · | Over the Internet. Go to the website of our tabulator, Broadridge, at www.proxyvote.com. Have your proxy card in hand when you access the website and follow the instructions to vote your shares. You must submit your Internet proxy before 11:59 p.m., Eastern Time, on Monday, June 19, 2017, the day before the Meeting, for your proxy to be valid and your vote to count. |

| · | By Telephone: Call 1-800-690-6903 or the number on your proxy card. Have your proxy card in hand when you call and then follow the instructions to vote your shares. You must submit your telephonic proxy before 11:59 p.m., Eastern Time, on Monday, June 19, 2017, the day before the Meeting, for your proxy to be valid and your vote to count. |

| · | By Mail. Complete and sign your proxy card and mail it to Broadridge in the postage prepaid envelope we provided. Broadridge must receive the proxy card not later than Monday, June 19, 2017, the day before the Meeting, for your proxy to be valid and your vote to count. |

| 3 |

| · | In Person at the Meeting. You can vote in person by attending the Meeting and delivering your completed proxy card in person or by completing a ballot, which we will provide to you at the meeting. |

If on the Record Date your shares are held in street name, the Notice of Internet Availability of Proxy Materials or hardcopies of the proxy materials are being forwarded to you by or on behalf of your bank, broker or other nominee. If you received the Notice of Internet Availability of Proxy Materials or hardcopies of the proxy materials directly from Broadridge, follow the instructions above for stockholders of record. If you received the Notice of Internet Availability of Proxy Materials or hardcopies of the proxy materials from your bank, broker or other nominee, follow the instructions provided by your bank, broker or other nominee explaining how you can vote. If you would like to vote in person at the Meeting, contact your bank, broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the Annual Meeting, along with a bank or brokerage statement or a letter from your nominee evidencing your beneficial ownership of our stock and a form of personal identification. A broker’s proxy is not the form of proxy enclosed with this Proxy Statement. You will not be able to vote shares you hold in street name in person at the Meeting unless you have a proxy from your bank, broker or other nominee issued in your name giving you the right to vote your shares.

What if I do not specify how my shares are to be voted?

If you are the stockholder of record and you submit a proxy but do not provide any voting instructions, your shares will be voted in accordance with the recommendations of our Board of Directors. If you hold your shares in street name and do not instruct your bank, broker or other nominee how to vote, it will nevertheless be entitled to vote your shares of common stock with respect to “discretionary” items but not with respect to “non-discretionary” items. In the case of a non-discretionary item, if you do not provide your broker or nominee with voting instructions, your shares of common stock will be considered “broker non-votes” on that proposal. Please note that the election of directors, the approval of our 2017 Employee Stock Purchase Plan and the approval of an amendment to our Amended and Restated 2014 Equity Incentive Plan are considered “non-discretionary” items and accordingly brokers and other nominees holding shares beneficially owned by their clients may not cast votes with respect to such proposals unless they have received voting instructions from their clients. If you are a beneficial owner of common stock, it is important that you provide instructions to your bank, broker or other holder of record so that your votes are counted.

Can I change my vote after I submit my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy with a later date. |

| · | You may send a written notice that you are revoking your proxy to us at Ekso Bionics Holdings, Inc., 1414 Harbour Way South, Suite 1201, Richmond, California 94804, Attention: Secretary. |

| · | You may attend the Meeting and vote in person (although simply attending the Meeting will not, by itself, revoke your proxy). |

If your shares are held in street name, you should contact your bank, broker or other nominee to revoke your proxy or, if you have obtained a legal proxy from your bank, broker or other nominee giving you the right to vote your shares at the Meeting, you may change your vote by attending the Meeting and voting in person.

| 4 |

How does the Board of Directors recommend I vote on the proposals?

Our Board of Directors recommends that you vote:

| · | FOR the election of each of the nominees for director; |

| · | FOR the approval of our 2017 Employee Stock Purchase Plan; |

| · | FOR the approval of an amendment to our Amended and Restated 2014 Equity Incentive Plan to increase the number of shares available for grant from 3,714,285 shares to 4,714,285 shares; and |

| · | FOR the ratification of OUM & Co., LLP as the Company’s independent auditors for the year ending December 31, 2017. |

Will any other business be conducted at the Meeting?

We know of no other business that will be presented at the Meeting. However, if any other matter properly comes before the stockholders for a vote at the Meeting, the proxy holders will vote your shares in accordance with their best judgment.

What votes are necessary to approve each of the proposals?

Election of Directors. The affirmative vote of a plurality of the votes cast by the holders of common stock is required to elect the nominees for director. If you vote “Withhold” with respect to one or more nominees, your shares will not be voted with respect to the person or persons indicated, although they will be counted for purposes of determining whether there is a quorum. Directions to “Withhold” and broker non-votes will have no effect on the outcome of this proposal.

Approval of 2017 Employee Stock Purchase Plan. The affirmative vote of a majority of the votes cast by the holders of common stock is required to approve the 2017 Employee Stock Purchase Plan. For this vote, abstentions and broker non-votes will not be counted as votes in favor and also will not be counted as shares voting on this matter. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Approval of Amendment to the Amended and Restated 2014 Equity Incentive Plan. The affirmative vote of a majority of the votes cast on the matter by the holders of common stock is required to approve the proposed amendment to the Amended and Restated 2014 Equity Incentive Plan. For this vote, abstentions and broker non-votes will not be counted as votes in favor and also will not be counted as shares voting on this matter. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Ratification of Appointment of OUM & Co., LLP. The affirmative vote of a majority of the votes cast by the holders of common stock is required to ratify the appointment of OUM & Co., LLP as the Company’s independent auditors for the year ending December 31, 2017. For this vote, abstentions and broker non-votes will not be counted as votes in favor and also will not be counted as shares voting on this matter. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have voted “Withhold” with respect to the original nominee.

| 5 |

All costs of solicitations of proxies will be borne by the Company. In addition to solicitations by mail, the Company’s directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telecopy, e-mail, personal interviews, and other means. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and the Company will reimburse them for their out-of-pocket expenses in connection therewith.

Deadline for Submission of Stockholder Proposals for Next Year’s Annual Meeting

Pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in the proxy statement for the Company’s next annual meeting of stockholders. For a proposal of a stockholder to be considered for inclusion in next year’s proxy statement, it must be received by our Corporate Secretary in writing at our principal offices, Ekso Bionics Holdings, Inc., 1414 Harbour Way South, Suite 1201, Richmond, California 94804, Attention: Corporate Secretary, no later than December 29, 2017.

Under our By-laws, if a stockholder wishes to present a proposal or wants to nominate candidates for election as directors at our next annual meeting of stockholders in 2018, such stockholder must give written notice to the Corporate Secretary of the Company at our principal executive offices at the address noted above. The Secretary must receive such notice not earlier than 120 day prior to the one year anniversary of the date of the Meeting and not less than 90 days prior to the one year anniversary of the date of the Meeting; provided, however, that in the event that the next annual meeting of stockholders is called for a date that is not within 30 days before or after the anniversary date of the Meeting, notice must be received by the Corporate Secretary not earlier than 120 days prior to the next annual meeting of stockholders and not later than the close of business on the 10th day following the day on which notice of the date of the next annual meeting of stockholders was mailed or public disclosure of the date of the next annual meeting of stockholders was made, whichever first occurs.

Our By-laws also specify requirements as to the form and content of a stockholder’s notice. The Company will not entertain any proposals or nominations that do not meet those requirements.

PARTICIPANTS IN THE SOLICITATION

Under applicable regulations of the Securities and Exchange Commission, the directors and certain officers of the Company may be deemed to be “participants” in the solicitation of proxies by the Board of Directors in connection with the Meeting.

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the Securities and Exchange Commission, excluding exhibits, will be furnished without charge to any stockholder upon written request to the Company, 1414 Harbour Way South, Suite 1201, Richmond, California 94804, attention: Corporate Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” the Notice of Internet Availability of Proxy Materials and, if applicable, hardcopies of the proxy materials. This means that only one copy of our Notice of Internet Availability of Proxy Materials or hardcopy proxy materials may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of the Notice of Internet Availability of Proxy Materials or hardcopy proxy materials to you upon request if you call or write us at the following address or phone number: 1414 Harbour Way South, Suite 1201, Richmond, California 94804, (510) 984-1761. If you want to receive separate copies of our proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and phone number.

| 6 |

Background of Directors and Executive Officers

Set forth below are the name and age as of April 15, 2017 of each of our current directors and executive officers, the positions held by each director and executive officer with us, his or her principal occupation and business experience during the last five years, and the year of the commencement of his or her term as a director or executive officer. Additionally, for each director, included below is information regarding the specific experience, qualifications, attributes and skills that contributed to the decision by our Board of Directors (the “Board”) to nominate him or her for election as a director and the names of other publicly held companies of which he or she serves or has served as a director in the previous five years.

Directors are elected to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Executive officers are appointed by the Board and serve at its pleasure. There is no family relationship between any of our directors, director nominees or executive officers. Except as otherwise disclosed below, no director was selected as a director or nominee pursuant to any arrangement or understanding.

| Name | Age | Position | ||

| Directors | ||||

| Steven Sherman | 71 | Director and Chairman of the Board | ||

| Thomas Looby | 45 | Director, President and Chief Executive Officer | ||

| Daniel Boren | 43 | Director | ||

| Marilyn Hamilton | 68 | Director | ||

| Howard Palefsky | 70 | Director | ||

| Jack Peurach | 51 | Director | ||

| Stanley Stern | 60 | Director | ||

| Amy Wendell | 56 | Director | ||

| Executive Officers (who are not directors) | ||||

| Maximilian Scheder-Bieschin | 55 | Chief Financial Officer | ||

| Russdon Angold | 40 | President, EksoWorks | ||

| Gregory Davault | 49 | Vice President, Global Marketing | ||

| Russell DeLonzor | 55 | Vice President, Operations | ||

Directors

Steven Sherman is the Chairman of the Board of the Company and serves on both its Audit Committee (Chairman) and its Compensation Committee. Mr. Sherman has served on our Board since January 2014 and served on the board of directors of Ekso Bionics, Inc., our wholly owned subsidiary, from December 2013 until January 2014. Since 1988, Mr. Sherman has been a member of Sherman Capital Group, a Merchant Banking organization with a portfolio of private and public investments. In addition to the Company, Mr. Sherman is the former Chairman of Purple Wave Inc. Mr. Sherman is a founder of Novatel Wireless, Inc., Vodavi Communications Systems Inc. and Main Street and Main Inc. Previously, Mr. Sherman has served as a director of Telit; Chairman of Airlink Communications, Inc. until its sale to Sierra Wireless, Inc.; Chairman of Executone Information Systems; and as a director of Inter-Tel (Delaware) Incorporated. The Board has concluded that Mr. Sherman is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his extensive business experience and his financial and investment expertise.

| 7 |

Thomas Looby is the President and Chief Executive Officer and a director of the Company. Mr. Looby was appointed as Chief Executive Officer and elected as a director on April 18, 2016. Prior to that, he served as President and Interim Chief Executive Officer of the Company since February 2016 and as President and Chief Commercial Officer since October 2014. Mr. Looby has served on the Board since April 2016. As President and Chief Commercial Officer, Mr. Looby was responsible for expanding global sales and marketing operations, including overseeing our clinical, customer service and regulatory divisions. Mr. Looby joined the Company in April 2014 as the Company’s Chief Marketing Officer leading the development and execution of the Company’s global hospital and rehabilitation marketing strategy. Prior to joining the Company, from September 2006 to March 2014, Mr. Looby served as Senior Vice President and Chief Marketing Officer at Given Imaging, where he was responsible for worldwide market development for PillCam® capsule endoscopy and other novel diagnostic technologies to gastrointestinal diseases. Prior to joining Given Imaging, Mr. Looby also served as Corporate Director of Marketing and Business Development at Eastman Kodak. Mr. Looby attended the University of Notre Dame where he received a Bachelor of Science degree in Chemical Engineering and received his Master of Business Administration from the University of Dayton. The Board has concluded that Mr. Looby is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his business, operating, and medical device industry experience and his position as the Chief Executive Officer of the Company, which enables the Board to perform its oversight function with the benefit of management’s perspectives on the business.

Daniel Boren is a director of the Company and serves on both its Nominating and Governance Committee (Chairman) and its Audit Committee. He has served on our Board since January 2014 and served on the board of directors of Ekso Bionics, Inc. from April 2013 until January 2014. Since January 2013, Mr. Boren has served as the President of Corporate Development for the Chickasaw Nation. Prior to that role, Mr. Boren served as the elected representative of Oklahoma’s 2nd Congressional District in the U.S. House of Representatives from 2005 through 2013. Before his election to the U.S. House of Representatives, Mr. Boren was elected to the Oklahoma House of Representatives from 2002 to 2004. Mr. Boren also serves as a director of IBC Bank-Oklahoma, a division of International Bancshares Corporation. Mr. Boren earned his Bachelor of Science degree in Economics at Texas Christian University and went on to obtain a Master of Business Administration degree at the University of Oklahoma. The Board has concluded that Mr. Boren is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his experience in governance matters.

Marilyn Hamilton is a director of the Company and serves on its Nominating and Governance Committee. She has served on our Board since January 2014 and served on the board of directors of Ekso Bionics, Inc. from September 2011 until January 2014. In 2009, Ms. Hamilton founded StimDesigns LLC, a neurotechnology company that develops devices and distributes Galileo neuromuscular training devices for rehabilitation and has served as CEO from 2009 to present. In 2007, Ms. Hamilton launched Envision, a professional speaking and medical business consulting company, and has served as its CEO from 2007 to present. Prior to this role, Ms. Hamilton co-founded Motion Designs Inc. in 1979, a manufacturing and marketing company that pioneered innovative custom, ultra-lightweight Quickie wheelchairs that revolutionized the industry. She served in various executive roles in sales, marketing and product development at Motion Designs Inc. until it was sold ultimately to Sunrise Medical Inc., where Ms. Hamilton served as Global VP. In 1990, Ms. Hamilton founded Winners on Wheels, a coed-scouting program for children in wheelchairs. In 2003, she co-founded Discovery through Design and served as Chairwoman, raising awareness and funds for spinal cord injury research and women’s health. For nine years, from 1994 to 2002, she served as a founding board member and currently serves as emeritus board member of The California Endowment. For four years, from 2010 to 2014, she has served as an advisory board member of the National Center for Medical Rehabilitation Research at the National Institute of Health. Since 1993, Ms. Hamilton has been a member of The Committee of 200 business women whose mission is to foster, celebrate and advance women’s leadership in private and public companies. Ms. Hamilton holds a Bachelor of Science in Education and Secondary Teaching Credential from California Polytechnic State University, San Luis Obispo. The Board has concluded that Ms. Hamilton is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, her 35 years of leadership expertise in business, the medical rehab industry, and her dedication to, and organizational and governance experience gained from, not-for-profit service.

| 8 |

Howard Palefsky is a director of the Company and has served on our Board since March 2017. Since January 2016, Mr. Palefsky has served as President of Victoria Capital Management Inc., a family investment vehicle, through which he has served as an independent director, investor and adviser to private and public healthcare companies. From 2002 through 2015, Mr. Palefsky served as a managing director at Montreux Equity Partners, a private investment firm, where he focused on investing in revenue stage companies engaged in the healthcare industry. Prior to this role, from 1997 to 2002, Mr. Palefsky served as a CEO, private investor, independent board member and venture partner at Montreux Equity Partners. From 1978 to 1997, Mr. Palefsky served as the Chairman, President and Chief Executive Officer of Collagen Corporation, a pioneer in the aesthetic medicine field. Mr. Palefsky serves as a director of Olatec Therapeutics LLC and Adigica Health, Inc. He is also an advisor to Life Sciences Alternative Funding. While at Montreux, he served as a director of GC Aesthetics, moksha8 Pharmaceuticals Inc., Pulmonx, Inc., Colorescience, Inc., Percutaneous Systems, Inc., NovoStent Corporation, Pure Life Renal, Inc. and Avantis Medical Systems, Inc. Mr. Palefsky holds a Bachelor of Science degree in Mathematics from the City College of the City University of New York, and a Master of Business Administration from Stanford University. The Board has concluded that Mr. Palefsky is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his extensive experience as an entrepreneur, CEO, board chair, director and investor in the life sciences industry, including medical devices.

Jack Peurach is a director of the Company and serves on both its Compensation Committee (Chairman) and its Nominating and Governance Committee. He has served on our Board since January 2014 and served on the board of directors of Ekso Bionics, Inc. from July 2011 until January 2014. From 2011 to March 2017, Mr. Peurach served as the Executive Vice President, Products for SunPower Corp (NASDAQ: SPWR), where he was responsible for all aspects of SunPower’s PV modules and residential, commercial and utility PV systems. Prior to this role, from 2009 to 2011, Mr. Peurach served as Executive Vice President, Research and Development for SunPower, where he led the research and development efforts of the PV Cells, Modules and Systems. From 2008 to 2009, Mr. Peurach was the Vice President of the Advanced Product Development Group, and from 2007 to 2008, Mr. Peurach was the Senior Director of Product Development at SunPower. Prior to SunPower’s acquisition of PowerLight in 2007, Mr. Peurach served as PowerLight’s Vice President of Product Development. Earlier in his career, Mr. Peurach was a strategy consultant for Mercer Management Consulting and director of engineering at Berkeley Process Control, Inc. Mr. Peurach also serves as a director of MyCore Health, Inc. Mr. Peurach holds a Bachelor of Science degree in Mechanical Engineering from Michigan State University, a Master of Science degree in Mechanical Engineering from the University of California, Berkeley, and a Master of Business Administration, Finance and Entrepreneurship from the Wharton School, University of Pennsylvania. The Board has concluded that Mr. Peurach is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his product development experience and strategic insight.

Stanley Stern is a director of the Company and serves on its Audit Committee. He has served on our Board since December 2014. He currently is Managing Partner of Alnitak Capital, which he founded in 2013 to provide Board level strategic advisory services, primarily in technology related industries. Before founding Alnitak, Mr. Stern was a Managing Director at Oppenheimer & Co. from 1982 to 2000 and from 2004 to 2013, where, among other positions, he led the firm’s investment banking department and technology investment banking groups. Mr. Stern also held roles at Salomon Brothers, STI Ventures and C.E. Unterberg. Mr. Stern is currently the Chairman of the Board of Audiocodes Inc., a leader in VOIP infrastructure equipment, a member of the Board and Chairman of the Audit Committee of Foamix, Inc., the Chairman of the Board of Sodastream, the global leader of at home beverage makers and a Board member of Ormat Technologies, a global leader in geothermal energy. Previously, Mr. Stern was a member of the board of directors of Given Imaging, a member of the board of directors of Fundtech Inc., and chairman of the board of directors of Tucows, Inc. Mr. Stern holds a Bachelor of Arts in Economics and Accounting from City University of New York, Queens College, and a Master of Business Administration from Harvard University. The Board has concluded that Mr. Stern is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, his extensive business and finance experience, particularly in technology related industries.

| 9 |

Amy Wendell is a director of the Company and serves on both its Compensation Committee and Nominating and Governance Committee. She has served on our Board since April 2015. Since January 2016, Ms. Wendell has been a Senior Advisor for Perella Weinberg Partner’s Healthcare Investment Banking Practice. Her scope of responsibilities involves providing guidance and advice with respect to mergers and acquisitions and divestures for clients and assisting the firm in connection with firm-level transactions. Since 2015, Ms. Wendell has been a Senior Advisor for McKinsey’s Strategy and Corporate Finance Practice and also serves as a member of McKinsey’s Transactions Advisory Board to help define trends in mergers and acquisitions, as well as help shape McKinsey’s knowledge agenda. From 1986 until January 2015, Ms. Wendell held various roles of increasing responsibility at Covidien plc (including its predecessors, Tyco Healthcare and Kendall Healthcare Products), including engineering, product management and business development. Most recently, from December 2006 until Covidien’s acquisition by Medtronic plc in January 2015, she served as Senior Vice President of Strategy and Business Development, where she led the company’s strategy and portfolio management initiatives and managed all business development, including acquisitions, equity investments, divestitures and licensing/distribution. Ms. Wendell also serves as a director of AxoGen, Inc. and Hologic, Inc. She is Chairman of the Board of Por Cristo, a non-profit charitable medical service organization involved in health care work for at-risk women and children in Latin America. Ms. Wendell holds a Bachelor of Science degree in Mechanical Engineering from Lawrence Technological University and a Master of Science degree in Biomedical Engineering from the University of Illinois. The Board has concluded that Ms. Wendell is well-qualified to serve on the Board and has the requisite qualifications, skills and perspectives based on, among other factors, her broad healthcare management and governance experience and her knowledge of healthcare policy and regulation, patient care delivery and financing, and clinical research and medical technology assessment.

Executive Officers (Who are Not Directors)

Maximilian Scheder-Bieschin is the Chief Financial Officer of the Company and has served in that position since January 2014. Mr. Scheder-Bieschin joined Ekso Bionics, Inc. in January 2011 as its Chief Financial Officer. From November 2009 until he joined Ekso Bionics, Inc., Mr. Scheder-Bieschin was an independent consultant for a number of emerging technology companies, including Ekso Bionics, Inc. From March 2007 to October 2009, he was co-founder and CEO of Barefoot Motors, a designer and manufacturer of electric all-terrain vehicles. From October 2005 to February 2007, Mr. Scheder-Bieschin served as President of ZAP, a publicly-traded distributor of electric vehicles. From August 1997 to March 2004, Mr. Scheder-Bieschin lived in Frankfurt, serving in senior investment banking roles for BHF-Bank, ING Barings and Deutsche Bank. Mr. Scheder-Bieschin received his Bachelor of Arts degree in Economics from Stanford University. He attended New York University and Stanford University’s Executive Program.

Russdon Angold is a Co-Founder of the Company and has served as the President of EksoWorks, the Company’s engineering services division, since March 2014. Prior to his role as the President of EksoWorks, Mr. Angold served as Chief Technology Officer of the Company from January 2014 to March 2014 and as Chief Technology Officer of Ekso Bionics, Inc. from December 2011 until March 2014. From the founding of Ekso Bionics, Inc. in 2005 until December 2011, Mr. Angold served as Vice President of Engineering. Prior to joining Ekso Bionics, Inc., Mr. Angold held various engineering positions at Rain Bird Corporation, Berkeley Process Control and the Irrigation Training and Research Center in San Luis Obispo, California. Mr. Angold is also the Founding President and Chairman of the Bridging Bionics Foundation. Mr. Angold is a registered Professional Mechanical Engineer and holds a bachelor’s degree in BioResource and Agricultural Engineering from California Polytechnic State University, San Luis Obispo.

| 10 |

Gregory Davault is the Vice President, Global Marketing of the Company and has served in that position since joining the Company in March 2015. In this capacity, Mr. Davault drives global commercialization efforts for Ekso GTTM and manages the customer-facing departments of the medical business. On January 10, 2017, he was appointed to be an executive officer of the Company. From March 2009 to March 2015, Mr. Davault was the Vice President of Global Market Development at Given Imaging, now part of Medtronic, where he was responsible for creating and executing the go-to-market strategy for PillCam COLON Capsule Endoscopy. Mr. Davault also led corporate strategy and in his last role managed the PillCam franchise. From March 1990 to March 2009, Mr. Davault served in various sales and marketing roles with St. Jude Medical, Kimberly-Clark Healthcare, and Standard Register. Mr. Davault attended Indiana University where he received a Bachelor of Science degree in Marketing and received his Master of Business Administration from Georgia State University.

Russell DeLonzor is the Vice President of Operations for the Company and has served in that position since joining the Company in October 2015. Mr. DeLonzor is responsible for leading Research and Development, Manufacturing, Quality Assurance, and Regulatory Affairs. On January 10, 2017, he was appointed to be an executive officer of the Company. From May 2007 until joining the Company, Mr. DeLonzor was the President and Chief Operating Officer of Halt Medical, a developer of a minimally invasive alternative to hysterectomy. From December 2002 to May 2007, Mr. DeLonzor served as the Vice President of Research and Development at Sanarus Medical, a developer of a cryosurgical system for treating breast disease, where he was responsible for leading a team developing a novel cryosurgical system used for diagnosing and treating breast disease. From June 2000 until December 2002, Mr. DeLonzor served as Vice President of Research and Development for the $700 million Nellcor division of Tyco Healthcare, where he was responsible for developing and launching a new pulse oximetry platform. From July 1997 to June 2000, Mr. DeLonzor served as Vice President of Research and Development for the hospital products division of Mallinckrodt Pharmaceuticals (acquired by Tyco Healthcare for $4.2 billion), where he was responsible for expanding and maintaining a broad variety of products used by respiratory impaired patients. From July 1990 to July 1997, Mr. DeLonzor also held leadership positions in engineering at Nellcor Puritan Bennet (acquired by Mallinckrodt Pharmaceuticals), where he was responsible for leading teams developing and manufacturing a variety of high volume hospital products such as pulse oximetry sensors and disposable resuscitation devices. Mr. DeLonzor is a patented inventor, with more than 30 US patents issued along with foreign equivalents. Mr. DeLonzor received a Bachelor of Science degree in Mechanical Engineering from California State University, Sacramento, and earned a Master of Business Administration from the University of Phoenix.

Board Committees

The Board has established three standing committees — Audit, Compensation, and Nominating and Governance. Each Committee operates under a charter that has been approved by the Board. Current copies of the charters of the Audit, Compensation and Nominating and Governance Committees are posted in the Corporate Governance section of the Company’s website at www.eksobionics.com.

Audit Committee

The Audit Committee’s responsibilities include:

| · | appointing, evaluating, retaining, approving the compensation of, and assessing the independence of the Company’s independent auditor; |

| · | overseeing the work of the Company’s independent auditor, including through the receipt and consideration of certain reports from the independent auditor; |

| · | reviewing and discussing with management and the independent auditors the Company’s annual and quarterly financial statements and related disclosures; |

| · | monitoring the Company’s internal control over financial reporting, disclosure controls and procedures and the code of business conduct; |

| 11 |

| · | discussing the Company’s risk management policies; |

| · | establishing procedures for the receipt and retention of accounting related complaints and concerns; |

| · | developing and reviewing policies and procedures for reviewing and approving or ratifying related person transactions; |

| · | meeting independently with the Company’s internal audit staff, if any, independent auditors and management; and |

| · | preparing the Audit Committee Report required by Securities and Exchange Commission rules (which is included on page 27 of this Proxy Statement). |

The members of the Audit Committee are Messrs. Sherman (Chairman), Boren and Stern. The Board has determined that all members of the Audit Committee are independent as determined under Rule 10A-3 promulgated under the Exchange Act and as independence for audit committee members is defined by the Nasdaq Marketplace Rules. The Board has determined that Messrs. Sherman and Stern are “audit committee financial experts” within the meaning of Item 407(d)(5) of Regulation S-K. The Audit Committee met seven times during 2016.

Compensation Committee

The Compensation Committee’s responsibilities include:

| · | reviewing and approving (or, when the Compensation Committee deems it appropriate, recommending for approval by the Board) the compensation of the Company’s executive officers, including the Chief Executive Officer and the Company’s other executive officers; |

| · | overseeing the evaluation of the Company’s senior executives; |

| · | reviewing and making recommendations to the Board with respect to incentive-compensation and equity-based plans that are subject to Board approval; |

| · | approving tax-qualified, non-discriminatory employee benefit plans (and parallel nonqualified plans) for which stockholder approval is not sought and pursuant to which options or stock may be acquired by officers, directors, employees or consultants of the Company; |

| · | reviewing and making recommendations to the Board with respect to director compensation; and |

| · | overseeing and administering the Company’s equity incentive plans. |

The members of the Compensation Committee are Messrs. Peurach (Chairman) and Sherman and Ms. Wendell. Each of Messrs. Peurach and Sherman and Ms. Wendell are independent as independence for compensation committee members is defined under the Nasdaq Marketplace Rules. The Compensation Committee met ten times during 2016.

Nominating and Governance Committee

The Nominating and Governance Committee’s responsibilities include:

| · | identifying individuals qualified to become Board members; |

| 12 |

| · | recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees; |

| · | monitoring issues and developments related to matters of corporate governance; and |

| · | recommending to the Board, where appropriate, changes in corporate governance principles and practices. |

The members of the Nominating Committee are Messrs. Boren (Chairman) and Peurach and Mses. Hamilton and Wendell. Each of Messrs. Boren and Peurach and Mses. Hamilton and Wendell are independent directors as defined under the Nasdaq Marketplace Rules. The Nominating and Governance Committee met two times during 2016.

Pricing Committee

The Pricing Committee was an ad hoc committee set up by the Board of Directors to secure an underwritten public offering of the Company’s common stock. The members of the Pricing Committee were Steven Sherman, Stanley Stern and Thomas Looby. The Pricing Committee met three times during 2016.

Director Nominations

The process followed by the Nominating and Governance Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, evaluation of the performance on our Board of any existing directors being considered for nomination, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Nominating and Governance Committee and the Board.

In considering whether to recommend any particular candidates for inclusion in the Board’s slate of recommended director nominees, the Nominating and Governance Committee will apply the criteria set forth in the Company’s Corporate Governance Guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of the Company’s business and industry, experience, diligence, lack of conflicts of interest and the ability to act in the interests of all stockholders. The Nominating and Governance Committee will consider the value of diversity in the director nomination process. The Committee does not assign specific weights to particular criteria, and no particular criterion is a prerequisite for each prospective nominee. The Company believes that the backgrounds and qualifications of its directors, considered as a group, should provide a significant breadth of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Stockholders may recommend individuals to the Nominating and Governance Committee for consideration as potential director candidates by submitting their names to the Nominating and Governance Committee, c/o Corporate Secretary, 1414 Harbour Way South, Suite 1201, Richmond, California 94804. The Nominating and Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in the proxy card for the next annual meeting of stockholders.

Stockholders also have the right under our By-laws to directly nominate director candidates, without any action or recommendation on the part of the Nominating and Governance Committee or the Board, by following the procedures set forth in the second paragraph under the section entitled “Stockholder Proposals” above.

| 13 |

Compensation Processes and Procedures

Our Compensation Committee is responsible for reviewing and approving (or, when the Compensation Committee deems it appropriate, recommending for approval by the Board) the compensation of the Company’s Chief Executive Officer and the Company’s other executive officers, including salary, annual cash incentive compensation and long-term equity compensation. The Compensation Committee also periodically reviews and makes recommendations to the Board with respect to director compensation. If the Compensation Committee deems it appropriate, it may delegate any of its responsibilities to one or more Compensation Committee subcommittees.

The Compensation Committee meets regularly without the presence of executive officers, and in all cases the Chief Executive Officer and any other such officers are not present at meetings at which their compensation is determined. The Compensation Committee may invite the Chief Executive Officer to be present during the approval of, or deliberations with respect to, other executive officer compensation.

The Compensation Committee may, in its sole discretion, retain or obtain the advice of one or more compensation consultants. In January 2015, the Compensation Committee engaged Mercer LLC, a wholly-owned subsidiary of March & McLennan Companies (“Mercer”), as its independent compensation consultant, to obtain benchmarking data with respect to option grants to chief executive officers. In December 2016, the Compensation Committee engaged Aon Consulting, Inc., through its Radford subdivision (“Radford”), to conduct a review of executive and director compensation and pay practices.

Although our Compensation Committee considers the advice and recommendations of consultants as to option grants and other executive compensation programs, our Compensation Committee ultimately makes their own decisions about these matters. In the future, we expect that our Compensation Committee will continue to engage independent compensation consultants to provide additional guidance on our executive compensation programs.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during 2016 is or was previously an officer or employee of the Company or has any relationships requiring disclosure under Item 404 of Regulation S-K promulgated by the SEC.

None of the Company’s executive officers served during 2016 as members of the compensation committee or board of directors of any entity that had one or more executive officers serving as a member of our Compensation Committee or Board.

Board Determination of Independence

The Board has determined that all of the Board members, except Mr. Looby, are independent directors under the applicable standards of the SEC and the Nasdaq Marketplace Rules.

Communicating with the Independent Directors

The Board will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. Absent unusual circumstances or as contemplated by the committee charters, the Chairman of the Board (if an independent director), the lead independent director (if one has been elected), or otherwise the Chairman of the Nominating and Governance Committee shall, subject to advice and assistance from the general counsel or the Company’s outside legal advisors, (1) be primarily responsible for monitoring communications from stockholders and other interested parties, and (2) provide copies or summaries of such communications to the other directors as he or she considers appropriate. Stockholders who wish to send communications on any topic to the Board should address such communications to the Company’s Board of Directors, c/o Corporate Secretary, 1414 Harbour Way South, Suite 1201, Richmond, California 94804.

| 14 |

Board Meetings and Attendance

Our Board met 12 times during 2016. During 2016, each director attended at least 75% of the aggregate number of Board meetings and the number of meetings held by all committees on which he or she served, except for Mr. Palefsky, who joined the Board in March 2017, and Mr. Harding, who resigned as Chief Executive Officer and a director in February 2016. All of the current directors except Messrs. Palefsky and Stern attended the 2016 Annual Meeting of Stockholders.

Code of Ethics

The Company has adopted a Code of Ethics which is applicable to all directors, officers and employees of the Company. The Professional Conduct and Ethics Policy is available on the Company’s website at www.eksobionics.com. In addition, we intend to post on our website all disclosures that are required by law concerning any amendments to, or waivers from, any provision of the code.

Board Leadership Structure

The Company does not have a formal policy regarding the separation of its Chairman of the Board and Chief Executive Officer positions. However, the Board has determined that the roles of Chairman of the Board and Chief Executive Officer should be separated at the current time. Mr. Sherman, an independent director, has served as Chairman of the Board since January 2014. On April 18, 2016, the Board appointed Mr. Looby to serve as our Chief Executive Officer and also elected him as a director to fill the vacancy created by the resignation of Mr. Nathan Harding, who served as our Chief Executive Officer and director from January 2014 until February 2016.

Mr. Sherman’s duties include chairing meetings of the independent directors in executive session, facilitating communication between other members of our Board and the Chief Executive Officer, preparing or approving the agenda for regular Board meetings, determining the frequency and length of regular Board meetings and recommending when special meetings of our Board should be held, and reviewing and, if appropriate, recommending action to be taken with respect to written communications from stockholders submitted to our Board.

The Board believes that separating the roles of Chairman of the Board and Chief Executive Officer increases the independent oversight of the Company, provides our Chief Executive Officer with an experienced sounding board and enhances the independent and objective assessment of risk by our Board.

Role of Board in Risk Oversight

The responsibility for the day-to-day management of risk lies with the Company’s management, while the Board is responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. Material risks that management identifies are discussed and analyzed with the Board. However, in addition to the Board, the committees of the Board consider the risks within their areas of responsibility. The Audit Committee oversees the risks associated with the Company’s financial reporting and internal controls, as well as general business and operating risks. The Compensation Committee oversees the risks associated with the Company’s compensation practices for its employees. The Nominating and Governance Committee oversees the risks associated with the Company’s overall governance, corporate compliance policies and its succession planning process to ensure that the Company has a slate of qualified candidates for key management positions that may become open in the future. Each committee reports to our Board on a regular basis, including reports with respect to the committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

| 15 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Policies and Procedures for Related Person Transactions

It is the Company’s policy that each executive officer, director and nominee for election as director delivers to the Company annually a questionnaire that includes, among other things, a request for information relating to any transactions in which both the executive officer, director or nominee, or their family members, and the Company participates, and in which the executive officer, director or nominee, or such family member, has a material interest. Our Board reviews all such transactions reported to it by an executive officer, director or nominee in response to the questionnaire, or that are brought to its attention by management or otherwise. After review, the disinterested directors approve, ratify or disapprove such transactions. Management also updates the Board as to any material changes to proposed transactions as they occur. This policy is not in writing but is followed consistently by the Board.

Transactions with Related Persons

SEC rules require us to disclose any transaction since the beginning of the Company’s last fiscal year or currently proposed transaction in which the Company is a participant and in which any related person has or will have a direct or indirect material interest and in which the amount involved exceeds $120,000. A related person is any executive officer, director, nominee for director, or holder of more than 5% of the Company’s common stock, or an immediate family member of any of those persons. Except as described below, during 2016, the Company was not a party to any transaction where the amount involved exceeded $120,000 and in which an executive officer, director, director nominee or 5% stockholder (or their immediate family members) had a material direct or indirect interest.

On August 12, 2016, CNI Commercial LLC, a 5% stockholder of the Company, purchased 375,000 shares of the Company’s common stock in the Company’s public offering of 3,750,000 shares of common stock at the public offering price of $4.00 per share.

| 16 |

Summary Compensation Table

The following table sets forth information concerning the total compensation paid or accrued by us during the last two fiscal years to (i) all individuals that served as our principal executive officer or acted in a similar capacity at any time during the most recent fiscal year indicated; (ii) the two most highly compensated executive officers, other than the principal executive officer, who were serving as executive officers at the end of the most recent fiscal year indicated; and (iii) up to two additional individuals for whom disclosure would have been provided pursuant to clause (ii) above but for the fact that the individual was not serving as an executive officer at the end of the most recent fiscal year (each, a “named executive officer”).

| Salary | Bonus | Option Awards | Non-Equity

| All Other Compen- sation | Total | |||||||||||||||||||||||

| Name and Principal Position | Year | ($) | ($) | ($) (1) | ($) | ($) | ($) | |||||||||||||||||||||

| Thomas Looby(2) | 2016 | 313,125 | - | 523,451 | 85,750 | (3) | - | 922,326 | ||||||||||||||||||||

| President & Chief Executive Officer | 2015 | 225,000 | - | 721,227 | - | - | 946,227 | |||||||||||||||||||||

| Maximilian Scheder-Bieschin | 2016 | 242,708 | - | - | 49,000 | (3) | - | 291,708 | ||||||||||||||||||||

| Chief Financial Officer | 2015 | 225,000 | - | 282,143 | - | - | 507,143 | |||||||||||||||||||||

| Russdon Angold | 2016 | 225,000 | - | - | 32,400 | (3) | - | 257,400 | ||||||||||||||||||||

| President, EksoWorks | 2015 | 225,000 | - | 617,582 | - | - | 842,582 | |||||||||||||||||||||

| Gregory Davault(4) | 2016 | 215,000 | 92,250 | (5) | 14,351 | - | - | 321,601 | ||||||||||||||||||||

| Vice President, Global Marketing | - | - | - | - | - | - | - | |||||||||||||||||||||

| Russell DeLonzor(4) | 2016 | 220,000 | 81,080 | (6) | - | - | - | 301,080 | ||||||||||||||||||||

| Vice President, Operations | - | - | - | - | - | - | - | |||||||||||||||||||||

| Nathan Harding(7) | 2016 | 54,295 | - | - | - | 261,870 | 316,165 | |||||||||||||||||||||

| Former Chief Executive Officer | 2015 | 275,000 | - | 450,708 | - | - | 725,708 | |||||||||||||||||||||

| (1) | The amounts in the “Option Awards” column reflect the aggregate grant date fair value of stock options granted during the year computed in accordance with the provisions of FASB ASC Topic 718. The assumptions that we used to calculate these amounts are discussed in Note 14 to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2016. |

| (2) | Mr. Looby joined the Company in April 2014 and was appointed as President and Chief Commercial Officer on October 8, 2014. On February 23, 2016, he was appointed President and Interim Chief Executive Officer. On April 18, 2016, he was appointed as Chief Executive Officer. |

| (3) | Non-equity incentive plan compensation amounts were paid in March 2017 for work performed during 2016. |

| (4) | In January 2017, the Company determined that Gregory Davault and Russell DeLonzor were executive officers within the meaning of Exchange Act Rule 3b-7, and accordingly they have been included in the table above as individuals for whom disclosure would have been provided but for the fact that the individual was not serving as an executive officer at the end of the most recent fiscal year. |

| (5) | Includes a retention bonus of $60,000 for having stayed with the Company for one year that was paid in 2016 and a $32,250 bonus that was paid in March 2017 for work performed during 2016. |

| (6) | Includes a retention bonus of $50,000 for having stayed with the Company for one year that was paid in 2016 and a $31,080 bonus that was paid in March 2017 for work performed during 2016. |

| (7) | Mr. Harding served as Chief Executive Officer from November 2012 to February 23, 2016. All other compensation includes $217,708 of severance related payments, $39,662 of unused vacation and $4,500 of payments for continued health care coverage under COBRA. |

We have no plans in place and have never maintained any plans that provide for the payment of retirement benefits or benefits that will be paid primarily following retirement including, but not limited to, tax qualified deferred benefit plans, supplemental executive retirement plans, tax-qualified deferred contribution plans and nonqualified deferred contribution plans, except that the Company maintains a 401(k) retirement plan in which all eligible employees may participate by making elective deferral contributions to the plan. The Company does not make any matching contributions to the plan.

| 17 |

Except as indicated below under “Executive Compensation—Employment Agreements”, we have no contracts, agreements, plans or arrangements, whether written or unwritten, that provide for payments to the named executive officers listed above.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth certain information concerning stock options held by the Named Executive Officers as of December 31, 2016.

| Option Awards | ||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price ($) | Option Expiration Date | |||||||||||||

| Thomas Looby | 40,476 | (1) | 16,666 | - | 15.33 | 2/28/2024 | ||||||||||||

| Thomas Looby | 13,095 | (2) | 15,476 | - | 9.73 | 2/5/2025 | ||||||||||||

| Thomas Looby | 32,142 | (3) | 53,572 | - | 9.59 | 6/11/2025 | ||||||||||||

| Thomas Looby | - | (4) | 220,000 | - | 4.00 | 9/23/2026 | ||||||||||||

| Maximilian Scheder-Bieschin | 34,829 | (5) | - | - | 2.73 | 3/30/2021 | ||||||||||||

| Maximilian Scheder-Bieschin | 30,476 | (6) | - | - | 2.73 | 8/11/2021 | ||||||||||||

| Maximilian Scheder-Bieschin | 38,095 | (7) | - | - | 3.78 | 4/24/2022 | ||||||||||||

| Maximilian Scheder-Bieschin | 2,503 | (8) | 427 | - | 3.78 | 8/11/2023 | ||||||||||||

| Maximilian Scheder-Bieschin | 31,250 | (9) | 11,607 | - | 7.00 | 1/15/2024 | ||||||||||||

| Maximilian Scheder-Bieschin | 16,767 | (3) | 27,947 | - | 9.59 | 6/11/2025 | ||||||||||||

| Russdon Angold | 38,095 | (7) | - | - | 3.78 | 4/24/2022 | ||||||||||||

| Russdon Angold | 2,503 | (8) | 427 | - | 3.78 | 8/11/2023 | ||||||||||||

| Russdon Angold | 31,250 | (9) | 11,607 | - | 7.00 | 1/15/2024 | ||||||||||||

| Russdon Angold | - | - | 99,999 | (10) | 9.59 | 6/11/2025 | ||||||||||||

| Gregory Davault | 25,000 | (11) | 32,142 | - | 9.59 | 6/11/2025 | ||||||||||||

| Gregory Davault | 2,142 | (12) | 2,143 | - | 5.27 | 3/31/2026 | ||||||||||||

| Russell DeLonzor | 20,833 | (13) | 50,595 | - | 8.96 | 11/24/2025 | ||||||||||||

| Nathan Harding(14) | 38,095 | - | - | 3.78 | 4/24/2022 | |||||||||||||

| Nathan Harding(14) | 2,625 | - | 3.78 | 8/11/2023 | ||||||||||||||

| Nathan Harding(14) | 99,107 | - | - | 7.00 | 1/15/2024 | |||||||||||||

| Nathan Harding(14) | 29,762 | - | - | 9.59 | 6/11/2025 | |||||||||||||

| (1) | Option became exercisable as to 25% of the total number of shares on February 28, 2015, and thereafter vests in equal monthly installments for 36 months. |

| (2) | Options became exercisable as to 25% of the total number of shares on February 5, 2016 and thereafter vests in equal monthly installments for 36 months. |

| 18 |

| (3) | Option became exercisable as to 25% of the total number of shares on June 11, 2016, and thereafter vests in equal monthly installments for 36 months. |

| (4) | Options become exercisable as to 25% of the total number of shares on September 23, 2017 and thereafter vests in equal monthly installments for 36 months. |

| (5) | Options became exercisable as to 25% of the total number of shares on January 10, 2012, and thereafter vested in equal monthly installments for 36 months. |

| (6) | Options became exercisable as to 25% of the total number of shares on July 20, 2012, and thereafter vested in equal monthly installments for 36 months. |

| (7) | Options became exercisable as to 25% of the total number of shares on April 24, 2013 and thereafter vests in equal monthly installments for 36 months. |

| (8) | Options became exercisable as to 12.5% of the total number of shares on January 15, 2014, and thereafter vests in equal monthly installments for 42 months. |

| (9) | Option became exercisable as to 25% of the total number of shares on January 15, 2015 and thereafter vests in equal monthly installments for 36 months. |

| (10) | Represents a performance based option grant made on June 11, 2015. Options vest upon attaining certain predetermined sales amounts over twelve month periods ending on March 31, 2017, December 31, 2017 and December 31, 2018. As the predetermined sales amount over the twelve month period ended March 31, 2017 were not attained, the performance award representing 28,571 shares did not vest and expired on that day. |

| (11) | Options became exercisable as to 25% of the total number of shares on March 23, 2016 and thereafter vests in equal monthly installments for 36 months. |

| (12) | Options became exercisable as to 50% of the total number of shares on March 31, 2016 and the remained became exercisable on March 31, 2017. |

| (13) | Options became exercisable as to 25% of the total number of shares on October 23, 2016, and thereafter vests in equal monthly installments for 36 months. |

| (14) | In connection with his resignation as Chief Executive Officer, all of Mr. Harding’s then outstanding options that would have become vested during the 12-month period commencing on the date of his resignation if Mr. Harding continued to be employed became vested and exercisable on the date of his resignation. Options to purchase 65,031 shares in the aggregate were subject to accelerated vesting. |

Employment Agreements

On January 15, 2014, in connection with the merger of Ekso Acquisition Corp., a wholly-owned subsidiary of the Company with and into Ekso Bionics, Inc., which was the surviving corporation and thus became our wholly-owned subsidiary (the “Merger”), we entered into a two-year employment agreement with Messrs. Scheder-Bieschin, Angold and Harding. Effective October 8, 2014, the Board appointed Mr. Looby as President and Chief Commercial Officer of the Company. Mr. Looby entered into an employment agreement with the Company on March 19, 2015. The initial term of each of the employment agreements expired on January 15, 2016, after which the employment agreements are automatically renewed for successive one year periods, unless terminated by either party. Upon renewal of the employment agreements on January 15, 2016, the base salary for each of Messrs. Lobby, Scheder-Bieschin, Angold and Harding for 2016 was $225,000, $225,000, $225,000 and $275,000, respectively, in each case subject to increase as determined by our Board. On February 23, 2016, Mr. Harding resigned as the Chief Executive Officer of the Company, and Mr. Looby was appointed as our Interim Chief Executive Officer, in connection with which Mr. Looby’s base salary was increased to $275,000. In connection with his subsequent appointment as Chief Executive Officer in April 2016, Mr. Looby’s base salary was further increased to $350,000. On March 31, 2016, the Compensation Committee of the Board approved an increase in Mr. Scheder-Bieschin’s base salary to $250,000 per year.

| 19 |

On January 10, 2017, Messrs. Davault and DeLonzor were named as executive officers of the Company with annual salaries each of $235,000. Neither of Messrs. Davault and DeLonzor are party to an employment agreement with the Company.

On March 20, 2017, the Compensation Committee of the Board approved an increase in base salary for each of Messrs. Looby, Scheder-Bieschin, Angold, Davault and DeLonzer to $360,500, $263,000, $232,000, $235,000 and $235,000, respectively, effective April 1, 2017.

Under their employment agreements, each of Messrs. Looby, Scheder-Bieschin and Angold is eligible, at the discretion of the Board and/or the Chief Executive Officer, as applicable, to receive an annual bonus of up to 30% of his annual base salary. Under his employment agreement, Mr. Harding would have been eligible to receive an annual bonus of up to 50% of his annual base salary. As members of the senior management team who were not executive officers for 2016, Messrs. Davault and DeLonzor were eligible to participate in the Company’s bonus program, with a target bonus potential of 30% of annual base salary.

All or a portion of the bonuses payable to our named executive officers may, at the discretion of our Board, be based on the achievement of certain operational, financial or other milestones established, with respect to our named executive officers other than our Chief Executive Officer, by our Chief Executive Officer or Board in consultation with the named executive officer or established, with respect to the Chief Executive Officer, by our Board in consultation with our Chief Executive Officer. All or any portion of the annual bonus may be paid in cash, securities or other property.

Each of our named executive officers is entitled to receive perquisites and other fringe benefits that may be provided to, and is eligible to participate in any other bonus or incentive program established by us for, our executive officers. Each named executive officer and his dependents are also entitled to participate in any of our employee benefit plans subject to the same terms and conditions applicable to other employees. Each named executive officer will be entitled to be reimbursed for all reasonable travel, entertainment and other expenses incurred or paid by him in connection with, or related to, the performance of his duties, responsibilities or services under his employment agreement, in accordance with policies and procedures, and subject to limitations, adopted by us from time to time.